Service sector

Trends in Contribution of the Service Sector

Rising Share in GDP:

The service sector has become the dominant part of India’s economy.In 1950–51: around 30% of GDP

In 1990–91: around 40% of GDP

In 2020s: consistently 55–60% of GDP

This shows that services have been the fastest-growing sector since economic reforms.

High Growth Rates:

Since the 1990s, services like telecom, IT, finance, trade, transport, education, and healthcare have grown at 7–9% per year, higher than agriculture and industry.Structural Transformation without Industrialization:

Unlike Western nations where industrialization came before services, India experienced a direct shift from agriculture to services, bypassing large-scale industrial growth.FDI Concentration in Services:

Sectors like IT-BPM, financial services, telecom, and retail attract majority of FDI inflows, boosting investment and growth.Exports of Services Increasing Rapidly:

India is among the world’s top service exporters:IT and IT-enabled services (ITES)

Business process outsourcing (BPO)

Engineering and research services

Remittances through service jobs abroad

These have strengthened India’s global presence.

Employment Trends:

Although services contribute ~60% of GDP, they employ only 25–30% of the workforce, showing productivity differences across subsectors.

High-skill services (IT, finance) show high productivity, while low-skill services (retail, hospitality) remain labour-intensive and low productivity.

Causes of Rapid Increase of the Service Sector

Economic Reforms (Liberalisation):

Deregulation of telecom, insurance, banking, and foreign trade opened the door for rapid expansion.Growth of IT and Digital Revolution:

India’s large pool of English-speaking, technically skilled workers made the country a global outsourcing hub.Urbanisation and Rising Incomes:

Higher demand for retail, entertainment, tourism, transport, and financial services in cities.FDI and Global Integration:

Multinational service providers in telecom, finance, logistics and e-commerce boosted competition and innovation.Public Sector Withdrawal from Some Areas:

Privatisation and PPP models in telecom, airlines, and infrastructure created more space for private services.Demographic Advantage:

Large young population increased demand for education, healthcare, and digital services.Technology Adoption:

Mobile internet, fintech, app-based services, and online marketplaces expanded the service economy.

Integrated Service Policy

High-end services (IT, finance) are globally competitive, while many others (tourism, transport, health, education, retail) suffer from low productivity

- Skill Development and Human Capital Improvement

- Sector-specific training (tourism, healthcare, logistics, financial services).

- Creation of Service Skill Councils.

- Industry–academia partnerships.

- Impact: Enhances worker productivity, reduces skill mismatches.

- Skill Development and Human Capital Improvement

- Standardisation and Quality Certification

- National standards for hospitality, healthcare, transport, and educational services.

- Service quality benchmarks like ISO certification and customer grievance mechanisms.

- Impact: Improves reliability, reduces inefficiency, builds global competitiveness.

- Digitalisation of Service Delivery

- Expanding e-governance, digital payments, online marketplaces, and cloud services.

- Technology upgradation for MSME service providers.

- Impact: Reduces transaction costs and speeds up service delivery.

- Better Infrastructure for Services

- Transport, logistics, communication networks, airports, smart cities.

- Tourism infrastructure, medical service hubs, IT parks.

- Impact: Enhances the ability of service firms to operate efficiently.

- Regulatory Reforms

- Simplifying licensing, reducing compliance burden.

- Clear rules for e-commerce, fintech, telemedicine, online education.

- Impact: Encourages innovation and investment, reducing informal and low-quality operations.

- Promoting Exports of Services

- Incentives for IT services, consulting, design, animation, research, and healthcare tourism.

- Integrated Service Export Zones (on lines of IT SEZs).

- Impact: Boosts foreign exchange earnings and quality standards.

- Support for MSMEs in Services

- Access to credit, digital tools, marketing support.

- Impact: Helps small enterprises upgrade productivity and compete with large firms.

- Encouraging Public–Private Partnerships

- In healthcare, education, transport, and skill development.

- Impact: Improves quality of service delivery while reducing government burden.

Monetary Policy

Objectives

1. Price Stability (Control of Inflation)

Price stability is the primary objective. High inflation reduces purchasing power and disrupts growth.

RBI aims to maintain inflation at a tolerable and predictable level, especially under the flexible inflation targeting framework.

2. Economic Growth

Monetary policy also supports growth by ensuring adequate credit availability to productive sectors of the economy.

3. Financial Stability

RBI aims to maintain stability in the financial system by regulating banks, preventing asset bubbles, and ensuring confidence in financial institutions.

4. Exchange Rate Stability

Although not fixed, RBI intervenes in forex markets to avoid excessive volatility in the rupee, ensuring stability in external trade.

5. Control of Credit

To regulate the flow of bank credit to priority sectors and prevent misuse of credit for speculative purposes.

6. Promotion of Employment

Indirectly, by supporting growth and maintaining stable prices, monetary policy helps generate employment opportunities.

7. Developmental Role

RBI plays a supportive role in developing financial markets, modern payment systems, and promoting financial inclusion.

Evolution of the Present Monetary Policy Framework

1. Pre-1991: Controlled and Developmental Role

Monetary policy focused on developmental goals rather than strict inflation control.

Dominated by tools like Cash Reserve Ratio (CRR), Statutory Liquidity Ratio (SLR), and direct credit controls.

Interest rates were administered; financial markets were underdeveloped.

Monetisation of fiscal deficit (automatic RBI financing of government borrowing) was common.

2. Post-1991 Reforms: Market-Based Approach

Economic reforms introduced in 1991 marked a turning point.

Key changes:

Deregulation of interest rates.

Reduction of SLR and CRR.

Development of money markets (call money, government securities market).

Shift from direct controls to market-based instruments like repo and reverse repo.

Ending automatic monetisation through the 1997 Agreement between RBI and Government.

Monetary policy became more focused on controlling inflation and managing liquidity.

3. 1998–2005: Adoption of Multiple Indicators Approach

In 1998, RBI officially announced the Multiple Indicators Approach (MIA).

Under MIA, RBI monitored a wide set of indicators like

interest rates,

exchange rate,

bank credit,

fiscal situation,

trade data,

capital flows, and

inflation expectations.

This helped RBI respond to broader macroeconomic trends.

4. 2005–2015: Movement Toward Inflation Targeting

As inflation became persistent after 2008, RBI shifted emphasis towards price stability.

A formal framework started building with the Urjit Patel Committee Report (2014), which recommended adopting inflation targeting.

5. 2016-Present: Flexible Inflation Targeting Framework (FIT)

A historic change came with the amendment to the RBI Act (2016) which institutionalised inflation targeting.

Features of the New Framework:

1. Inflation Target

4% CPI inflation,

with a tolerance band of ± 2%.

Therefore, acceptable inflation is between 2% and 6%.

2. Monetary Policy Committee (MPC)

The MPC was created to bring transparency and collective decision-making.

Composition:

3 members from RBI (including Governor)

3 external experts appointed by the Government

3. Repo Rate as the Main Policy Instrument

The repo rate became the primary tool to signal monetary stance.

RBI uses repo to control liquidity and thereby influence inflation.

4. Accountability

If inflation remains outside 2–6% for three consecutive quarters, MPC must explain the failure and propose corrective action.

5. Communication Policy

MPC publishes:

minutes of meetings,

voting patterns,

inflation forecasts.

This improves transparency and credibility.

6. Current Framework Characteristics

Focused primarily on price stability, but also mindful of growth.

Uses modern tools like:

Repo / Reverse Repo

Open Market Operations (OMO)

Marginal Standing Facility (MSF)

Liquidity Adjustment Facility (LAF)

Standing Deposit Facility (SDF)

A combination of flexibility and predictability defines the system

MSME sector

Challenges

1. Limited Access to Finance

MSMEs struggle to obtain timely and affordable credit.

High collateral requirements, complex documentation, and risk perception by banks reduce credit flow.

Many enterprises operate in the unorganised sector, making formal loans difficult.

2. Technological Obsolescence

Majority use outdated technologies.

Low investment capacity limits adoption of automation, digital tools, and modern production methods.

Results in lower productivity and poor competitiveness.

3. Poor Infrastructure

Inadequate access to industrial land, electricity, logistics facilities, and transport networks.

Raises production costs and reduces efficiency.

4. Low Productivity and Skill Gaps

Lack of skilled labour, limited training facilities, and low managerial capability.

Productivity levels are far below global standards.

5. Marketing Constraints

Difficulty accessing domestic and global markets.

Weak branding, limited digital marketing, dependence on intermediaries.

Inability to meet quality standards required for exports.

6. Regulatory Burden

Complex compliance requirements: GST filing, labour laws, environmental norms.

Small units face high administrative costs relative to their scale.

7. Delayed Payments

Large companies and government departments frequently delay payments.

Affects cash flow, working capital, and survival of MSMEs.

8. Competition from Imports

- Cheap imported goods (especially from China) threaten MSMEs in electronics, toys, textiles, engineering goods.

9. Informality

A majority of micro enterprises are unregistered.

This limits access to formal credit, government schemes, and global markets.

Impact of Global Shocks

- COVID-19 severely disrupted supply chains, labour mobility, and demand, exposing structural vulnerabilities.

Policy Measures to Support MSMEs

1. MSMED Act, 2006

Provides a legal framework for defining MSMEs based on investment and turnover.

Ensures protection against delayed payments through the Micro and Small Enterprises Facilitation Council (MSEFC).

2. Priority Sector Lending (PSL)

Banks are required to allocate 40% of credit to priority sectors including MSMEs.

Introduces special schemes like Mudra loans for micro units.

3. Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE)

Offers collateral-free loans up to ₹2 crore.

Reduces risk for banks and improves access to finance.

4. PMMY (Pradhan Mantri Mudra Yojana)

Provides loans under Shishu, Kishore, Tarun categories for micro businesses.

Focuses on first-time entrepreneurs and small service units.

5. Udyog Aadhaar / Udyam Registration

Simplified one-page online registration.

Helps MSMEs access subsidies, credit schemes, and market linkages.

6. Cluster Development Programme (MSE-CDP)

Supports creation of technology centres, common facility centres, skill hubs, testing labs.

Enhances competitiveness through shared resources.

7. Technology Upgradation Schemes

Credit Linked Capital Subsidy Scheme (CLCSS): 15–20% subsidy for upgrading machinery.

Establishment of Technology Centres offering advanced tools and training.

8. Market Support Initiatives

Public procurement policy: 25% of government purchases reserved for MSMEs (including 4% for SC/ST and 3% for women enterprises).

Government e-Marketplace (GeM) for direct selling to government departments.

Export promotion through SEZs, EPCs, and participation in global fairs.

9. Digital and Innovation Support

Digital MSME scheme: encourages cloud computing and e-commerce adoption.

Start-Up India: supports innovation through funding, incubation, and tax incentives.

10. Relief Measures After COVID-19

Under Atmanirbhar Bharat:

₹3 lakh crore emergency credit line for MSMEs.

Revision of MSME definition (investment + turnover criteria) to expand coverage.

No global tenders for government procurement up to ₹200 crore.

Equity infusion through Fund of Funds.

11. Skill Development

PM Kaushal Vikas Yojana (PMKVY)

Entrepreneurship and Skill Development Programme (ESDP)

These improve workforce productivity and managerial capabilities.

12. Infrastructure Development

- Industrial corridors, plug-and-play facilities, common service centres, and improved logistics through Gati Shakti.

India’s external trade

Important Changes in the Direction of India’s External Trade

1. Shift from Traditional Partners (UK, USA) to Asian Economies

Earlier, India’s major trade partners were the US, UK, and EU.

Now a large share of trade is with China, ASEAN nations, UAE, Saudi Arabia, and other Asian economies.

2. Rise of China as India’s Largest Trading Partner

- China has become the top source of imports, especially in electronics, chemicals, machinery, and pharmaceuticals.

3. Increasing Trade with ASEAN

- After India–ASEAN FTA, trade with Singapore, Malaysia, Thailand, Indonesia, Vietnam has expanded.

4. Trade with Africa and Latin America Growing

India imports crude oil from Nigeria and Angola.

Exports pharmaceuticals, automobiles, and engineering goods to Africa and Latin America.

5. Diversification of Export Markets

- India has reduced overdependence on EU and US and diversified towards Middle East, East Asia, and Africa.

Important Changes in the Composition of India’s External Trade

1. Rise of Manufactured and High-Value Exports

Information technology services, engineering goods, chemicals, pharmaceuticals, and automobiles dominate exports.

Share of primary goods has declined.

2. Decline in Export of Traditional Goods

- Textiles, jute, tea, and leather have lost global competitiveness due to competition from Bangladesh, Vietnam, and China.

3. Expansion of Petroleum and Petrochemical Trade

India's refining capacity has grown.

Exports of petroleum products have increased.

But crude oil remains the largest import item, causing vulnerability.

4. Import Composition: Technology, Electronics, and Capital Goods

- Electronics, telecom equipment, integrated circuits, and capital machinery have replaced earlier imports of food grains.

5. Growth of Services Trade

India is among the top exporters of software, IT-enabled services, business services, and financial services.

Services exports are more than $250 billion, providing crucial foreign exchange earnings.

Reduction of Current Account Deficit (CAD)?

India has often faced a CAD due to high import dependence on oil, gold, and electronic goods. Whether recent trade changes reduce CAD depends on several factors.

HELPFUL

1. Growth of Services Exports

India’s services exports have increased substantially.

IT and business services generate a large trade surplus, which partially offsets the merchandise trade deficit.

This helps in narrowing CAD.

2. Rise of High-Value Manufacturing Exports

Pharmaceuticals, auto components, and engineering goods earn stable foreign exchange.

Export diversification reduces vulnerability to global shocks.

3. Increase in Petroleum Product Exports

India exports refined petroleum products using imported crude.

This adds value and improves trade balance.

4. Trade Diversification

- Reduced dependence on Western markets makes India’s export earnings more stable.

NOT HELPFUL ENOUGH

1. High Import Dependence on Oil

Crude oil accounts for 20–25% of total imports.

Rising global oil prices directly widen CAD.

2. Increasing Imports of Electronics

Electronics have become the second-largest import item after oil.

Lack of domestic semiconductor production increases dependence on China and East Asia.

3. Gold Imports Remain High

- Cultural preference for gold leads to annual imports of 700–900 tonnes, worsening CAD.

4. Weakness in Merchandise Exports

Labour-intensive exports like textiles, leather, and gems & jewellery have not grown fast enough.

Export competitiveness is limited by high logistics cost and infrastructure gaps.

5. Trade Deficit with China

India has a large and growing trade deficit with China, crossing $70–80 billion.

This single deficit offsets gains from other regions.

SUGGESTIONS

While the new trade pattern supports stability, India is still likely to face a CAD unless:

domestic manufacturing strengthens (especially electronics),

renewable energy reduces oil imports,

export competitiveness improves

Demographic Dividend

1. Concept of Demographic Dividend (4 marks)

Demographic Dividend refers to the potential economic growth that can result from changes in a country’s age structure—especially when the proportion of the working-age population (15–64 years) becomes larger than the dependent population (children and elderly).

This situation creates an opportunity for:

Higher labour supply

Increased savings

Greater productivity

Faster economic growth

India is currently experiencing this phase because over 65% of its population is in the working-age group, making it one of the youngest countries in the world.

However, demographic dividend is not automatic. It becomes a dividend only if the workforce is educated, skilled, healthy, and productively employed.

How Can India Harness the Benefits of Demographic Dividend?

1. Investing in Education and Skill Development

Improve school learning outcomes and higher education quality.

Strengthen vocational training, apprenticeships, and digital skills.

Align skills with industry needs (manufacturing, IT, healthcare, logistics).

This increases employability and productivity of the youth.

2. Creating Productive Employment Opportunities

Boost labour-intensive sectors (textiles, tourism, food processing, construction).

Promote MSMEs and startups, which generate maximum jobs.

Encourage manufacturing through schemes like Make in India, PLI, and industrial corridors.

Without job creation, demographic dividend may turn into demographic burden.

3. Improving Health and Nutrition

Healthy workers are more productive.

Reduce malnutrition, anaemia, and maternal health issues.

Expand access to affordable healthcare and insurance (Ayushman Bharat).

This ensures that the working-age population is not only large but capable.

4. Enhancing Women’s Labour Force Participation

Provide childcare support, maternity benefits, flexible work, and safe workplaces.

Educate girls and delay early marriage.

Increasing women’s participation can add millions of workers to the labour force.

5. Promoting Entrepreneurship and Innovation

Support startups with credit, incubators, digital platforms, and market access.

Encourage youth-led innovation in technology, agriculture, and services.

Entrepreneurship converts demographic strength into economic dynamism.

6. Strengthening Urban Infrastructure

Better transport, power, housing, and digital connectivity attract investment.

Planned urbanisation can absorb large labour inflows from rural areas.

7. Regional Development

India’s demographic dividend is uneven—states like Kerala and Tamil Nadu are ageing, while Bihar, UP, MP, and Rajasthan have younger populations.

Policies must focus on:

Migration management

Skill matching

Investments in lagging states

8. Governance and Labour Reforms

Simplify labour laws

Improve ease of doing business

Reduce red tape

This encourages investment and job creation.

Instruments and Institutions of State Intervention

A. Instruments of State Intervention

1. Fiscal Policy

Government uses taxation and public expenditure to influence production, employment, and income distribution.

Examples: subsidies, public investment, progressive taxes.

2. Monetary Policy

Through the RBI, the state regulates money supply, interest rates, and credit to stabilise prices and maintain financial stability.

3. Regulatory Measures

Laws and regulations governing labour markets, environment, competition, prices, and quality standards.

Examples: Competition Act, labour codes, environmental norms.

4. Public Sector Enterprises (PSEs)

Government directly participates in production through PSUs in sectors such as energy, transport, and mining where private sector is unwilling or unable to invest.

5. Trade and Industrial Policies

Import tariffs, export incentives, licensing, and industrial promotion policies to guide industrial development and protect domestic industry.

6. Welfare and Social Policies

Provision of healthcare, education, food security (PDS), MGNREGA, social security, and poverty alleviation programmes to ensure equity and social justice.

B. Institutions of State Intervention

1. Central Government

Formulates economic policies (Budget, industrial policy, trade policy).

2. Reserve Bank of India

Implements monetary policy and ensures financial stability.

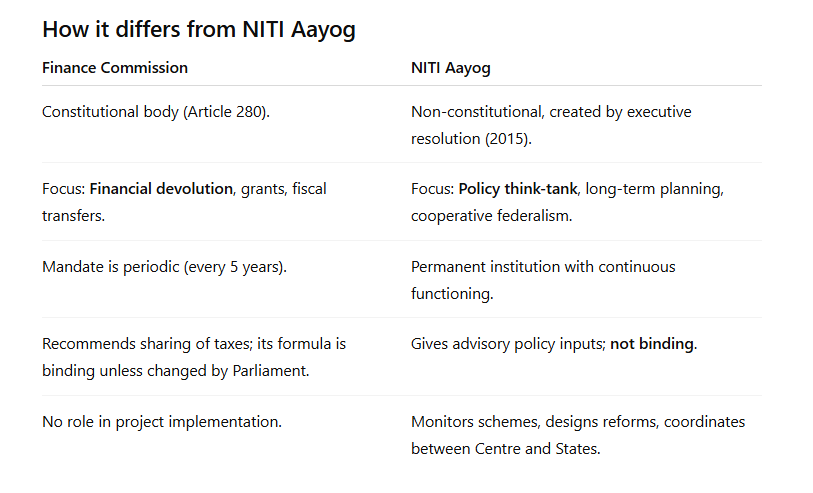

3. Planning Bodies / NITI Aayog

Provides long-term strategies, coordination, and development planning.

4. Regulatory Authorities

SEBI (capital markets), TRAI (telecom), IRDAI (insurance), CCI (competition), etc.

5. Public Sector Enterprises

Undertake strategic production, infrastructure creation, and service provision.

6. State Governments & Local Bodies

Implement policies in agriculture, education, health, labour markets, and local infrastructure.

Need for State Intervention in the Market

1. Correcting Market Failures

Markets may fail due to monopoly power, information asymmetry, public goods, and externalities (pollution).

State intervention ensures efficient allocation of resources.

2. Promoting Equity and Reducing Inequality

Markets typically favour those with higher incomes.

Government uses taxation, subsidies, welfare schemes, and affirmative policies to promote distributive justice.

3. Providing Public Goods and Essential Services

Private sector does not produce goods like defence, roads, basic healthcare, and sanitation because they are non-profitable.

The state ensures their provision.

4. Stabilising the Economy

To manage inflation, unemployment, recessions, and booms, the government uses fiscal and monetary policies to maintain macroeconomic stability.

5. Supporting Strategic Sectors

Certain sectors (energy, defence, railways) require huge investments and have national security implications.

State intervention ensures development of such sectors.

6. Protecting Vulnerable Groups

The poor, farmers, unorganised workers, and small businesses need state support through minimum wages, MSP, subsidies, and social safety nets.

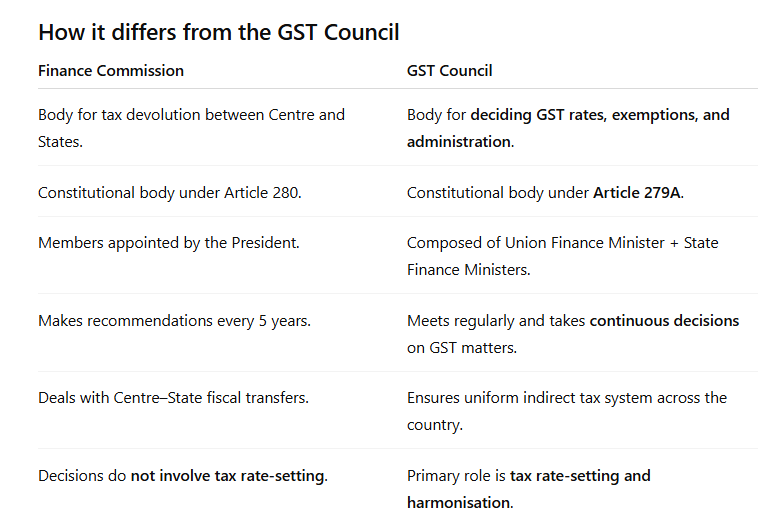

Fiscal Federalism

Fiscal federalism refers to the system of financial relations between different levels of government—central, state, and local bodies—within a federal structure. It determines:

how revenue-raising powers are distributed,

how expenditure responsibilities are assigned, and

how financial transfers (grants, tax devolution) flow from the Centre to the States.

In India’s federal system, fiscal federalism is essential because:

states have large expenditure responsibilities (health, education, agriculture, law and order)

but limited taxation powers (mainly GST share, excise on alcohol, property tax, stamp duties).

Hence, fiscal federalism ensures efficient resource allocation, equity among states, and balanced regional development.

Critical Issues in Fiscal Federalism in India

1. Vertical Imbalance

There is a mismatch between:

Centre’s large revenue-raising powers, and

States’ larger expenditure responsibilities.

States depend heavily on transfers through Finance Commissions and centrally sponsored schemes.

2. Horizontal Imbalance

Different states have unequal:

revenue capacities,

development needs, and

population sizes.

Economically stronger states (Maharashtra, Gujarat, Karnataka) collect higher revenues, while poorer states rely more on central transfers—leading to persistent regional disparities.

3. GST and Revenue Uncertainty

The introduction of GST in 2017 replaced many state taxes, reducing states’ fiscal autonomy.

Critical issues:

Dependence on GST compensation from the Centre.

Lower-than-expected GST collections.

Delayed compensation during COVID-19 created friction.

4. Increasing Centralisation of Resources

A rising share of revenue is tied in Centrally Sponsored Schemes (CSS).

States have limited flexibility in designing programmes according to local needs.

After the 14th Finance Commission increased tax devolution, the Centre reduced untied grants, limiting states’ autonomy.

5. Borrowing Constraints on States

Under the FRBM Act and central regulations:

states’ borrowing is capped,

their fiscal deficit must remain within limits set by the Centre.

This restricts states’ ability to invest in infrastructure and social sectors.

6. Declining Role of Finance Commissions

While Finance Commissions decide tax-sharing and grants every 5 years,

their recommendations often clash with:

GST Council decisions,

centrally sponsored programmes,

NITI Aayog advisory roles.

This creates ambiguity in the institutional structure of fiscal federalism.

7. Political Issues and Centre–State Conflict

Political differences influence:

allocation of funds,

approval of schemes,

negotiations within the GST Council.

Opposition-ruled states often accuse the Centre of discrimination in discretionary transfers.

8. Weak Fiscal Capacity of Local Governments

Panchayats and municipalities collect very little revenue and rely overwhelmingly on state transfers.

This undermines the 73rd and 74th Constitutional Amendments and restricts grassroots development.

How Is Fiscal Imbalance Measured?

Fiscal imbalance is measured using the following key indicators:

1. Fiscal Deficit

Fiscal Deficit = Total Expenditure – (Revenue Receipts + Non-debt Capital Receipts)

A rising fiscal deficit indicates growing imbalance.

2. Revenue Deficit

Revenue Deficit = Revenue Expenditure – Revenue Receipts

Shows whether the government is borrowing to meet current consumption expenditure.

3. Primary Deficit

Primary Deficit = Fiscal Deficit – Interest Payments

Indicates fiscal stress excluding interest burden.

4. Debt–GDP Ratio

High public debt relative to GDP signals long-term imbalance.

5. Interest Payment Burden

A rising share of interest payments in total expenditure reflects unsustainable deficits.

These indicators together show the extent and nature of fiscal imbalance in the economy.

Fiscal Responsibility and Budget Management (FRBM) Act in Correcting Fiscal Imbalances

The FRBM Act was enacted in 2003 to ensure fiscal discipline by limiting deficits and public debt.

Its goals:

Reduce fiscal deficit to 3% of GDP

Eliminate revenue deficit

Improve transparency and macroeconomic stability

A. Achievements

1. Improved Fiscal Discipline in Early Years (2003–2008)

Fiscal deficit declined from around 6% of GDP (early 2000s) to below 3.5%.

Revenue deficit also reduced significantly.

This showed positive impact of FRBM targets.

2. Greater Transparency and Reporting

- Mandatory fiscal statements, Medium-Term Fiscal Policy (MTFP) reports, and debt data improved transparency.

3. Institutionalizing Fiscal Responsibility

States enacted their own FRBM laws, improving fiscal health across the country.

The Act created a culture of rule-based fiscal policy.

4. Anchoring of Market Expectations

- Bond markets gained confidence due to predictable fiscal path, lowering borrowing costs.

B. Limitations and Challenges

1. Frequent Deviations from Targets

Global Financial Crisis (2008), economic slowdown, and Covid-19 forced continuous deviations.

FRBM escape clauses were frequently used.

2. Revenue Deficit Not Eliminated

Government still borrows for revenue expenditure, which FRBM aimed to stop.

3. Capital Expenditure Constraints

Pressure to meet fiscal targets sometimes led to cuts in capital expenditure—hurting growth.

4. Off-Budget Borrowings

Food subsidy arrears, oil bonds, and special purpose vehicles allowed governments to keep deficits artificially low, reducing effectiveness.

5. Lack of Strong Penalties

FRBM has no strict enforcement mechanism; compliance depends on political will.

Production and productivity of major food crops

Trends in Production of Major Food Crops in the Post–Green Revolution Era

1. Significant Increase in Foodgrain Output

Foodgrain production rose from about 72 million tonnes in 1965–66 to over 330 million tonnes in 2022–23.

Wheat and rice showed the highest growth due to HYVs, irrigation, fertilizers, and mechanisation.

2. Regional Concentration

Production growth was concentrated in Punjab, Haryana, and Western Uttar Pradesh, creating regional imbalances.

Later, states like MP, Chhattisgarh, Bihar, and Odisha increased production due to NFSM and MSP reforms.

3. Crop Diversification in Recent Decades

While wheat and rice grew rapidly initially, recent years show:

Higher production of pulses (tur, urad, moong) due to price incentives.

Increase in coarse cereals (jowar, bajra, maize) due to climate-resilient farming and government promotion.

Trends in Productivity of Major Food Crops

1. Steady Rising Productivity of Wheat and Rice

Wheat productivity increased from 1.3 tonnes/ha (1970s) to >3.4 tonnes/ha.

Rice productivity increased from 1.1 tonnes/ha to >2.8 tonnes/ha.

This reflects advances in seed technology and irrigation.

2. Pulses and Coarse Cereals Show Late Improvement

Pulses remained stagnant for decades but improved after 2008 due to MSP hikes and micro-irrigation.

Maize productivity increased sharply because of hybrid seeds.

3. Productivity Growth Slowing Down Recently

Stagnation in traditional Green Revolution states due to:

soil degradation,

overuse of water,

declining input response.

New states (MP, Rajasthan, Chhattisgarh) are now driving productivity gains.

Steps Taken by the Government to Increase Productivity of Food Crops

1. High-Yielding Varieties (HYVs) and Seed Programmes

Promotion of high-yield and climate-resilient varieties.

National Seeds Corporation and State Seed Farms ensure availability of quality seeds.

2. Expansion of Irrigation

Major, medium, and micro-irrigation projects.

PMKSY (Pradhan Mantri Krishi Sinchai Yojana) for “Har Khet Ko Pani”.

Promotion of drip and sprinkler systems.

This reduces dependence on monsoon.

3. Improved Input Use

Subsidies on fertilizers, soil health cards for balanced nutrient use.

Promotion of organic and natural farming in some regions.

4. MSP and Procurement Policies

Minimum Support Price for wheat, rice, pulses, coarse cereals.

Public procurement incentivises farmers to adopt improved technologies and invest more.

5. National Food Security Mission (NFSM)

Launched in 2007 to increase production of rice, wheat, pulses, coarse grains.

Provides assistance for:

improved seeds,

soil amendments,

farm machinery,

cropping system intensification.

NFSM significantly improved productivity in central and eastern India.

6. Use of Technology and Mechanisation

Custom Hiring Centres for tractors, harvesters, planters.

Promotion of farm mechanisation through subsidies.

Digital tools (Kisan apps, remote sensing) for precision agriculture.

7. Strengthening Research & Extension

ICAR and agricultural universities focus on new varieties, pest-resistant seeds, and climate-resilient farming.

Krishi Vigyan Kendras help transfer technology to farmers.

8. Crop Insurance and Risk Management

PMFBY (Pradhan Mantri Fasal Bima Yojana) protects farmers from climatic shocks.

Encourages continued investment in productivity-enhancing inputs.

Environmental consequences of economic development

1. Air Pollution and Deterioration of Air Quality

- Rapid urbanisation, rise in vehicles, thermal power plants, construction dust, and industrial emissions have made Indian cities among the most polluted globally.

- Delhi, Mumbai, Kanpur, Lucknow, and other urban centres consistently record high PM2.5 and PM10 levels.

- Health impacts include respiratory diseases, heart ailments, and reduced life expectancy.

2. Water Pollution and Water Stress

- Industrial effluents, untreated sewage, pesticides from agriculture, and waste disposal have polluted rivers like the Ganga, Yamuna, and Cauvery.

- Over-extraction of groundwater for agriculture and urban use has caused depletion of aquifers.

- Many states face severe groundwater stress (Punjab, Haryana, Rajasthan, Tamil Nadu).

3. Land Degradation and Soil Erosion

- Intensive agriculture, excessive fertilizer use, monocropping, and deforestation have degraded soil quality.

- Around 30% of India’s land suffers from degradation due to erosion, salinization, and nutrient loss.

4. Loss of Forests and Biodiversity

- Infrastructure projects, mining, urban expansion, and agricultural conversion have reduced forest cover in many regions.

- Loss of wildlife habitats has endangered species like tigers, elephants, and various birds and reptiles.

5. Climate Change Impacts

India’s rising carbon emissions from energy, industry, and transport contribute to global warming.

- Consequences include:

rising temperatures,

irregular monsoons,

more frequent floods and droughts,

extreme weather events (heatwaves, cyclones).

6. Solid Waste and Plastic Pollution

- Urban growth has created enormous volumes of municipal waste.

- Inefficient waste management leads to landfill overflows, groundwater contamination, and plastic accumulation in rivers and oceans.

- Single-use plastics remain a major contributor.

Why Have These Environmental Impacts Increased?

1. Rapid Industrialisation and Urbanisation

- Over the last two decades, India’s focus on manufacturing, construction, transport, mining, and real estate has increased environmental pressure.

- Expansion of cities has created congestion, waste, and air pollution.

2. Energy Demand and Fossil Fuel Dependence

- Economic growth led to a surge in energy demand.

- Coal-based power plants, which account for the majority of electricity generation, emit high levels of CO₂, SO₂, and particulate matter.

3. Agricultural Intensification

- High-yield farming uses large quantities of fertilizers, pesticides, and irrigation, degrading land and polluting water.

- Groundwater overuse is common in states dependent on tube wells.

4. Weak Environmental Regulations and Enforcement

- Although India has environmental laws, enforcement is often weak due to limited capacity, corruption, and political pressure to prioritise growth over sustainability.

- Industries often discharge untreated waste into rivers and air.

5. Pressure of Population Growth

- India’s rising population increases demand for energy, water, housing, and infrastructure.

- More consumption generates more waste and stress on natural resources.

6. Climate Vulnerability and Unsustainable Development Patterns

- Development often occurs without considering ecological sensitivity—hills, coasts, and forest areas are used for roads, hydropower, mining, and tourism.

- This has led to landslides, coastal erosion, and loss of ecosystem services.

Regional disparities

Causes

1. Historical and Geographical Factors

States with fertile land (Punjab, Haryana) or coastal access (Maharashtra, Gujarat, Tamil Nadu) industrialised earlier.

Hilly, arid, and tribal regions (Northeast, Rajasthan, Jharkhand) faced natural constraints such as poor soil, difficult terrain, and weak connectivity.

2. Uneven Industrial Development

Industrial investment is concentrated in states with better infrastructure and urbanisation.

Backward states lacked electricity, transport, skilled labour, and capital, discouraging private investment.

3. Inadequate Infrastructure

Poor roads, limited irrigation, weak power supply, and low digital connectivity in eastern and central India restrict economic opportunities.

Better infrastructure in western and southern states attracts industries and services.

4. Low Human Development Levels

States like Bihar, Uttar Pradesh, Odisha, and MP have lower literacy rates, poor healthcare, and high population pressure.

Low human capital reduces productivity and growth.

5. Agricultural Backwardness

Dependence on monsoon, small landholdings, and low productivity trap many regions in subsistence agriculture.

Lack of diversification and irrigation widens gaps with regions practicing commercial agriculture.

6. Administrative and Governance Weaknesses

Corruption, inefficient governance, delays in project implementation, and weak law and order discourage investment.

Some states are unable to utilise central funds effectively.

7. Lack of Urbanisation

Urbanisation creates jobs and markets.

States with fewer cities experience slower industrial and service-sector growth.

Steps Taken by the Government to Reduce Regional Disparities

1. Special Category Status and Financial Assistance

Northeastern states, Himachal Pradesh, Uttarakhand, and J&K received higher central grants, tax exemptions, and subsidies.

Aimed at improving infrastructure and attracting investment.

2. Backward Regions Grant Fund (BRGF)

Targeted funding for backward districts to improve infrastructure, governance, and development planning.

Focus on districts in Bihar, Odisha, Rajasthan, MP, and UP.

3. Decentralised Planning: 73rd and 74th Amendments

Empowered Panchayats and Municipalities to plan and implement local development activities.

Improved allocation of resources based on local needs.

4. Promotion of Industrial Development in Backward Regions

Freight equalisation policies (historically), tax incentives, and establishment of industrial estates.

Creation of SEZs, industrial corridors (Delhi–Mumbai, Amritsar–Kolkata), and Mega Food Parks.

5. Infrastructure Development Initiatives

Bharatmala, Sagarmala, UDAN, rural electrification, and PMGSY (rural roads).

These projects connect remote regions with markets and improve mobility.

6. Targeted Schemes for Agriculture and Rural Development

PMKSY (irrigation), NFSM (food crops), and watershed development programs support backward agricultural regions.

MGNREGA provides employment and builds rural assets.

7. Northeastern and Tribal Area Development

Dedicated ministries and schemes like

North Eastern Council (NEC),

DONER Ministry,

Tribal Area Sub-Plan (TASP),

Aspirational Districts Programme (2018) targeting the most backward 112 districts.

8. Fiscal Transfers through Finance Commissions

- Horizontal devolution ensures higher transfers to poorer states based on population, income distance, and need.

- Creates fiscal space for backward states to invest in social and physical infrastructure.

Social security schemes

The Government of India has launched several social security schemes aimed at providing protection to the poor, workers, elderly, and vulnerable groups. Major schemes include:

1. National Social Assistance Programme (NSAP)

Includes:

Indira Gandhi National Old Age Pension Scheme (IGNOAPS)

Widow Pension Scheme (IGNWPS)

Disability Pension Scheme (IGNDPS)

Provides direct pensions to elderly, widows, and disabled persons from poor households.

2. Pradhan Mantri Jan Dhan Yojana (PMJDY)

Financial inclusion scheme offering bank accounts with:

accident insurance,

life insurance,

overdraft facility.

3. Insurance Schemes (2015 Onwards)

Pradhan Mantri Suraksha Bima Yojana (PMSBY): Accidental death/disability insurance.

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY): Life insurance for low-income groups.

4. Atal Pension Yojana (APY)

A contributory pension scheme for unorganised sector workers guaranteeing ₹1,000–₹5,000 monthly pension after 60 years.

5. Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA)

Ensures 100 days of unskilled wage employment to rural households—provides income security.

6. Employees’ Provident Fund (EPF) & Employees’ State Insurance (ESI)

For organised sector workers, offering social security, health insurance, and retirement benefits.

Drawbacks of MGNREGA

1. Delay in Wage Payments

Payments often get delayed due to slow administrative processing, shortage of funds, and technical issues in the banking system.

2. Corruption and Leakages

Ghost beneficiaries, fake job cards, and inflated muster rolls reduce the effectiveness of the scheme.

3. Poor Quality of Assets Created

Many works (ponds, roads, check dams) remain unfinished or poorly maintained due to weak planning and technical supervision.

4. Lack of Awareness Among Workers

Many households are not aware of their legal entitlement to demand work for 100 days, leading to underutilisation.

5. Insufficient Number of Skilled Supervisors

Limited technical staff causes poor planning, low productivity, and delays in completing projects.

6. Seasonal and Irregular Work Availability

Work is not available throughout the year in many areas, despite the legal guarantee.

Additional Problems Observed in Implementation

1. Inadequate Funding and Budget Cuts

Funds often run short, leading to delayed payments and rationing of work.

2. Political Interference

Local elites sometimes influence work allocation, favouring certain groups and excluding others.

3. Poor Monitoring and Social Audits

Though social audit is mandatory, many states do not conduct them properly, weakening accountability.

4. Limited Impact on Skill Development

Since work is mostly unskilled, it does not create long-term employability for workers.

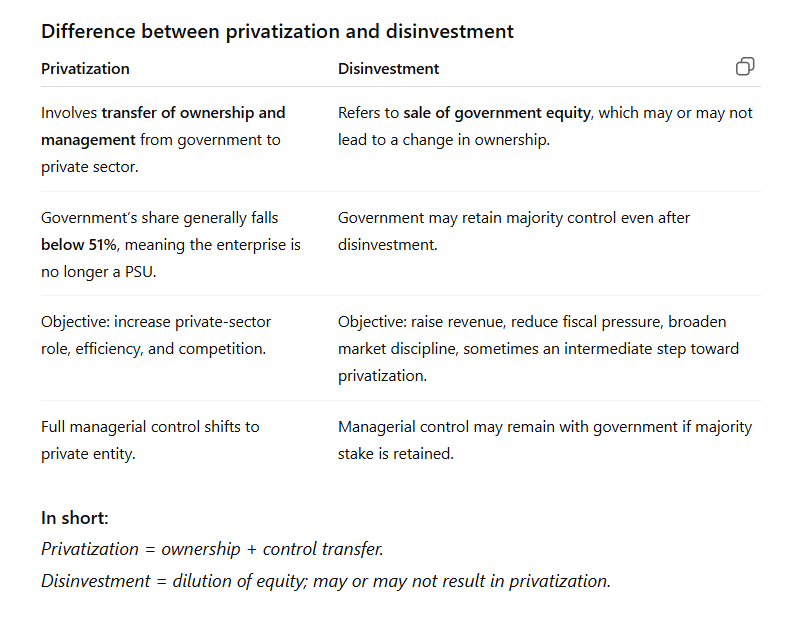

Disinvestment vs. Privatisation

What is disinvestment?

Disinvestment refers to the sale of a part or whole of the government’s equity holdings in Public Sector Enterprises (PSEs).

The objective is usually to reduce the fiscal burden, raise resources, increase efficiency, and introduce private-sector discipline into public enterprises.

It may involve selling shares to the public, financial institutions, or strategic private partners.

Conditions needed for making disinvestment policy a success

Clear and Consistent Policy Framework

– Government must set transparent objectives: revenue generation, efficiency improvement, or strategic restructuring.

– Policies should be stable over time to build investor confidence.Strong Regulatory Mechanism

– Independent regulators in sectors like power, telecom, civil aviation etc.

– Ensures fair competition and prevents private monopolies after disinvestment.Proper Valuation of PSUs

– Accurate valuation is crucial to avoid selling assets below their real worth.

– Professional valuation agencies and transparent bidding processes are needed.Efficient Capital Market Conditions

– A well-functioning stock market ensures optimal pricing of government shares.

– Adequate demand from institutional and retail investors improves success.Political Consensus and Public Support

– Political resistance often delays or reverses disinvestment.

– Consensus reduces uncertainty and helps in smooth implementation.Selection of Strategic Partners

– When strategic disinvestment is done, credible private players with the ability to modernize and improve efficiency must be chosen.Improved Corporate Governance in PSUs

– Professional management, autonomy, and accountability make PSUs more attractive to investors.Transparency in Process

– Open bidding, published criteria, and third-party oversight build trust and minimise controversies.

Policies regarding PPP (Public-Private Partnership)

The Government of India follows a structured, model-based and facilitative PPP policy aimed at expanding infrastructure through private participation while safeguarding public interest.

Key features include:

Promotion of PPPs in core infrastructure such as roads, ports, airports, power, railways, urban services, and health/education.

Standardized PPP frameworks like the Model Concession Agreement (MCA), Viability Gap Funding (VGF) scheme, and Guidelines for Appraisal of PPP Projects.

Transparent bidding and competitive procurement through the Public Private Partnership Appraisal Committee (PPPAC).

Risk-sharing between public and private partners, where risks are allocated to the party best able to manage them.

Financial support through VGF (up to 40% of project cost), India Infrastructure Finance Company Ltd. (IIFCL), and long-term financing through infrastructure funds.

Institutional strengthening with bodies like NITI Aayog’s PPP Cell and the Department of Economic Affairs (DEA) Infrastructure Division

Benefits to India from PPP collaboration

PPP has significantly accelerated infrastructure creation, improved service quality, and reduced public expenditure burden. Major benefits include:

1. Rapid expansion of transport infrastructure

Golden Quadrilateral & National Highways (PPP in BOT/DBFOT models): Improved connectivity, reduced travel time, and increased freight efficiency.

Mumbai–Pune Expressway and Delhi–Gurgaon Expressway: High-quality highways built faster than public sector alone could manage.

2. Modernization of airports

Delhi and Mumbai Airports (GMR & GVK consortia): Expanded terminals, world-class infrastructure, higher passenger handling capacity.

Hyderabad and Bengaluru Airports: Built entirely through PPP, now major aviation hubs.

3. Urban infrastructure improvements

Delhi Metro Airport Express Line (PPP with Reliance Infra): Faster airport connectivity.

Nagpur and Indore Smart City Projects: Private participation in water supply, waste management, and ICT services.

4. Power sector advancement

- Ultra Mega Power Projects (Mundra, Sasan) through PPP: Large additions to power generation capacity and lower tariff bids.

5. Community and health services

Andhra Pradesh e-Seva, Karnataka’s Nemmadi Centres: PPP-enabled digital service delivery to citizens.

National Dialysis Programme (PPP in district hospitals): Increased access to affordable dialysis.

Finance Commission & NITI Aayog

The Finance Commission of India is a constitutional body established under Article 280.

Its main function is to recommend how financial resources should be distributed between:

Union and States (vertical devolution), and

Among the States themselves (horizontal distribution).

It also recommends:

Principles for grants-in-aid,

Measures to improve fiscal discipline,

Ways to augment the resources of panchayats and municipalities.

The Commission is appointed every five years and is independent of the government.

Discussion on Centre-state relations

Centre–state relations have become a central topic of debate in India because the federal structure must continuously adapt to political, economic, and administrative changes. As India has moved from a one-party dominant system to coalition politics, from a planned economy to a market-oriented system, and from centralised governance to decentralisation, the balance of power between the Centre and States has come under scrutiny.

Reasons for conflict

1. Fiscal Imbalance (Vertical and Horizontal)

The Centre controls major tax sources, while States have higher expenditure responsibilities.

Dependence on central transfers (Finance Commission, grants, CSS schemes) creates tensions.

2. Centralisation in Planning and Resource Allocation

Central schemes and conditions under Centrally Sponsored Schemes (CSS) often reduce States’ flexibility.

States demand more decision-making power and untied funds.

3. GST-Related Concerns

Loss of independent taxation powers after GST.

Delays in GST compensation created friction between the Centre and several States.

4. Political Differences

When different parties govern the Centre and States, disputes arise over misuse of agencies, Governor’s role, fund allocation, and policy priorities.

Non-BJP states have often accused the Centre of bias in resource distribution.

5. Role of Governors

Governors, appointed by the Centre, sometimes withhold bills, delay approvals, or intervene politically.

States view this as an encroachment on their autonomy.

6. President’s Rule (Article 356)

Historically used excessively, especially before the 1990s, to dismiss state governments.

Though reduced after the S.R. Bommai judgment, concerns remain.

7. Inter-State Water Disputes

Centre’s tribunals and interventions sometimes conflict with state interests.

Examples: Cauvery dispute, Krishna-Godavari, Ravi-Beas.

8. Internal Security and Law & Order

- Issues like deployment of central forces, anti-terror laws, and AFSPA create friction with States who seek greater control over policing.

9. Devolution to Local Bodies

- Centre’s and State’s competing claims over local governance create administrative overlap.

Foreign Capital

Types

Foreign capital refers to all inflows of external financial resources into a country. Major types include:

1. Foreign Direct Investment (FDI)

Investment by a foreign entity in productive assets such as factories, infrastructure, or services.

It involves ownership, control, technology transfer, and long-term commitment.

2. Foreign Portfolio Investment (FPI)

Investment in financial assets like shares, bonds, and securities.

It is short-term, market-driven, and does not involve management control.

3. External Commercial Borrowings (ECBs)

Loans raised by Indian companies from foreign lenders at commercial rates.

Includes bank loans, buyers’ credit, and suppliers’ credit.

4. Foreign Aid (Official Development Assistance)

Grants, concessional loans, or technical assistance provided by foreign governments or international institutions (World Bank, ADB, IMF).

5. NRI/Overseas Deposits

Non-resident Indians invest in bank deposits like FCNR, NRE, NRO accounts.

6. Venture Capital and Private Equity from Foreign Investors

Funds for startups and high-growth firms involving risk-sharing.

Foreign Capital Contributes to Economic Growth

1. Investment and Capital Formation

FDI increases the availability of funds for industrial expansion, infrastructure creation, and modernization.

2. Technology Transfer

Foreign firms bring advanced technology, managerial skills, and innovation that improve productivity.

3. Employment Generation

FDI-led projects create direct jobs and additional indirect employment through supply chains.

4. Export Promotion

Multinational firms help integrate India into global value chains (IT services, automobiles, pharma).

5. Improved Competition and Efficiency

Entry of global firms increases competition, reducing costs and improving quality.

6. Development of Infrastructure

FDI in telecom, airports, power, and roads helps build critical infrastructure.

7. Foreign Exchange Earnings

Boosts exports, increases reserves, and stabilizes the balance of payments.

Important Reforms Introduced to Attract FDI in India

1. Liberalization of FDI Policy (Post-1991)

- Automatic route introduced in many sectors

- Higher sectoral caps (e.g., telecom, insurance, defence)

- Reduction in bureaucratic approvals

2. Opening of New Sectors

100% FDI allowed in single-brand retail, construction, e-commerce marketplaces, railway infrastructure, healthcare, and renewable energy.

Defence sector increased to 74% automatic and 100% with approval.

3. Simplification through Automatic Route

More than 90% of FDI inflows come through automatic approval, reducing delays.

4. Make in India and Production-Linked Incentive (PLI) Schemes

Enhanced incentives for electronics, solar, pharma, semiconductors, automobiles, and textiles to attract foreign manufacturers.

5. Establishment of Invest India

A national investment promotion agency offering facilitation, dispute redressal, and single-window clearance.

6. Ease of Doing Business Reforms

GST introduction

Insolvency and Bankruptcy Code (IBC) for faster dispute resolution

Digital approvals, online licensing, and reduced compliance burden

7. Special Economic Zones (SEZs) and Industrial Corridors

World-class infrastructure and tax incentives to attract foreign firms.

8. Bilateral Investment Treaties and Tax Reforms

Revised treaties to ensure investor confidence while preventing tax evasion.

Institutional Structure for Good Governance

The Constitution of India establishes a comprehensive institutional framework to promote accountability, transparency, rule of law, and efficient public administration, all essential for good governance. Key constitutional provisions include:

1. Legislature (Parliament and State Legislatures)

Makes laws, approves budgets, and holds the executive accountable through debates, questions, and committees.

Ensures democratic oversight and representation.

2. Executive (Union and State Governments)

Responsible for implementing laws, delivering public services, and maintaining administration.

Operates under constitutional limits and judicial scrutiny.

3. Judiciary (Supreme Court, High Courts, Subordinate Courts)

Guarantees rule of law, protects fundamental rights, and checks arbitrary power.

Judicial review ensures governance within constitutional boundaries.

4. Comptroller and Auditor General (CAG)

Independent authority responsible for auditing government accounts and expenditures.

Ensures financial accountability.

5. Election Commission of India (ECI)

Conducts free and fair elections, a core requirement of good governance.

Regulates political parties, voter rolls, and election procedures.

6. Union and State Public Service Commissions (UPSC & SPSC)

Ensure merit-based recruitment for civil services.

Prevents political interference and builds administrative professionalism.

7. Finance Commission

Ensures fair distribution of financial resources between Centre and States.

Promotes fiscal federalism.

8. Local Self-Governments (Panchayats and Municipalities)

Enabled by the 73rd and 74th Constitutional Amendments.

Decentralises power and promotes participatory governance.

Major Oversight / Watchdog Institutions and Their Roles

1. Comptroller and Auditor General (CAG)

Audits accounts of Union, States, PSUs, and autonomous bodies.

Identifies misuse of funds, inefficiency, and corruption.

Reports submitted to Parliament for scrutiny by Public Accounts Committee (PAC).

2. Election Commission of India (ECI)

Conducts and supervises elections at all levels.

Ensures fairness, monitors political finance, and enforces model code of conduct.

3. Central Vigilance Commission (CVC)

Apex anti-corruption body for the central government.

Supervises vigilance administration, investigates corruption cases, and protects whistle-blowers.

4. Central Bureau of Investigation (CBI)

- Premier investigative agency handling corruption, economic crimes, and high-profile criminal cases.

5. Lokpal and Lokayuktas

Independent anti-corruption ombudsmen created under the Lokpal and Lokayuktas Act, 2013.

Investigate corruption complaints against public officials.

6. National Human Rights Commission (NHRC)

Investigates human rights violations by public authorities.

Recommends reforms, compensation, and safeguards.

7. Information Commissions (Central & State)

Created under the Right to Information Act, 2005.

Promote transparency by ensuring citizen access to government information.

8. Competition Commission of India (CCI)

Ensures fair competition and prevents abuse of market power.

Protects consumer interest and maintains economic governance.

9. Public Accounts Committee (PAC) & Estimates Committee

Parliamentary committees scrutinize public expenditure and administrative efficiency.

Strengthen accountability of the executive.

Malnutrition

Malnutrition refers to a condition in which a person’s intake or absorption of nutrients is inadequate, excessive, or imbalanced, affecting growth, health, and productivity.

It includes:

Undernutrition – stunting (low height), wasting (low weight for height), underweight, micronutrient deficiencies (iron, iodine, Vitamin A, zinc).

Overnutrition – overweight and obesity resulting from excess calorie intake.

Hidden hunger – deficiency of essential vitamins and minerals even when calorie intake is adequate.

Why treat malnutrition?

1. Long-term impact on human capital

Malnourished children suffer from poor cognitive development, low learning ability, and reduced future productivity.

2. High infant and child mortality

Undernutrition contributes to nearly 45% of under-five deaths, making it a major public health concern.

3. Inter-generational cycle of poverty

Malnourished mothers give birth to low-birth-weight babies, perpetuating poor health across generations.

4. Reduced economic growth

A less healthy workforce lowers productivity and increases health expenditure; malnutrition can reduce GDP by 2–3%.

5. Increased disease burden

Weak immunity leads to higher susceptibility to infections, increasing doctor visits and financial stress on families.

6. Social and gender inequality

Women and girl children are disproportionately affected due to unequal access to food and healthcare.

Measures to Address Malnutrition

1. Strengthening nutrition programmes

Expand and improve Integrated Child Development Services (ICDS), Anganwadi services.

Ensure effective implementation of Mid-Day Meal (MDM) and POSHAN Abhiyaan.

2. Maternal health and nutrition

Promote antenatal care, iron–folic acid supplementation, and counselling for pregnant and lactating mothers.

Encourage institutional deliveries and breastfeeding (early initiation + exclusive breastfeeding for 6 months).

3. Food security improvements

Strengthen Public Distribution System (PDS) with fortified staples (iron, folic acid, Vitamin A).

Provide diversified food baskets including pulses, millets, vegetables, and eggs.

4. Micronutrient supplementation and food fortification

- Salt iodisation, fortified rice/wheat, Vitamin A and iron supplements for children and women.

5. Water, sanitation, and hygiene (WASH)

- Reduce infections through safe drinking water, toilets, and hygiene awareness.

6. Behavioural change and awareness

- Educate families on balanced diets, child feeding practices, spacing of births, and hygiene.

7. Targeted interventions for vulnerable groups

- Tribal populations, migrant workers, urban poor, and disaster-affected communities need special support.

External Debt

External debt refers to the total outstanding borrowings of a country that need to be repaid in foreign currency.

It includes loans taken by the Government, private sector, public enterprises, commercial banks, and monetary authority from international agencies, foreign governments, and global financial markets.

These debts must be repaid through future foreign exchange earnings, making external debt an important indicator of a country’s external sector stability.

Magnitude of India’s External Debt (Brief Overview)

India’s external debt has grown steadily over the decades but remains manageable relative to GDP.

Total external debt is around 20% of GDP, which is considered moderate by international standards.

India’s foreign exchange reserves are large enough to cover most of the short-term external liabilities, indicating a low external vulnerability.

The composition has shifted over time toward long-term and less risky debt, reducing rollover risk.

Public sector debt remains significant, but private sector borrowings (ECBs, NRI deposits) have grown.

Overall, India is regarded as a country with a sustainable external debt position.

Characteristics of India’s External Debt

1. Dominance of Long-Term Debt

Over 80% of India’s external debt is long-term.

Short-term debt (which poses repayment risk) is relatively low.

2. Government vs. Private Sector Share

Government (sovereign) debt is substantial but declining as a share.

Private sector—especially corporates—borrows through External Commercial Borrowings (ECBs) and NRI deposits.

3. Concessional Nature of Multilateral Debt

- A portion of external debt comes from the World Bank, ADB, and bilateral lenders at low interest rates, which reduces the burden.

4. Low Debt-Service Ratio

- India’s Debt Service Ratio (DSR)—the proportion of export earnings used for debt repayment—remains low, showing healthy capacity to pay.

5. Currency Composition

External debt is mainly denominated in US dollars, followed by SDRs, yen, and euro.

This exposes India to exchange-rate risk, especially when the rupee depreciates.

6. Comfortable Foreign Exchange Reserves

- India’s forex reserves cover most short-term debt, giving high external stability.

7. Increasing Share of Non-Government Debt

- Corporates, banks, and NRI deposits now make up a large portion of total debt, reducing direct fiscal burden on government.

Indian Manufacturing Suffers from Weak Competitiveness

Indian manufacturing has consistently struggled to compete globally due to a mix of structural, infrastructural, and policy-related weaknesses. Major reasons include:

1. High Cost of Doing Business

Expensive logistics, slow transportation, port congestion.

High cost of electricity, land, and compliance.

Complex labour laws increase administrative burden.

2. Infrastructure Bottlenecks

Inadequate power supply, poor industrial corridors, and weak last-mile connectivity.

Delays in transport increase inventory and production costs.

3. Low Technology Adoption

Many firms use outdated technology, leading to low productivity.

Limited R&D investment (less than 1% of GDP).

Slow diffusion of automation, robotics, and digital manufacturing.

4. Small Firm Size and Fragmentation

A majority of firms are micro or small; they lack economies of scale.

Difficulty in accessing credit and skilled labour.

5. Skill Shortages

- Mismatch between training and industry needs.

- Low productivity due to lack of technical and vocational skills.

6. Rigid Labour Market and Regulatory Complexity

Multiplicity of labour laws, high compliance burden.

Smaller firms stay informal to avoid regulatory costs.

7. Low Export Orientation

Indian manufacturers are less integrated into global value chains.

High tariffs on inputs reduce export competitiveness.

8. Limited Innovation Ecosystem

Weak industry–academia linkages.

Low patenting and limited venture capital for manufacturing innovation.

Policy Measures to Improve Competitiveness

1. Improve Infrastructure and Logistics

Expand industrial corridors (DMIC, CBIC), SEZs, and plug-and-play industrial parks.

Strengthen multimodal logistics, reduce port and freight charges.

2. Promote Technology Upgrading

Provide incentives for automation, digitalisation, and Industry 4.0 technologies.

Increase public–private R&D spending and support innovation clusters.

3. Labour Law Reforms

Simplify and unify labour codes to reduce compliance cost.

Encourage formalisation and flexibility in hiring.

4. Access to Affordable Finance

Expand credit guarantee schemes and low-interest loans for MSMEs.

Promote development finance institutions for long-term industrial credit.

5. Skill Development

Strengthen Skill India, ITIs, apprenticeships, and industry-linked training.

Promote sector-specific skill councils.

6. Strengthen Global Value Chain Integration

Reduce tariffs on intermediate goods.

Promote export-oriented manufacturing through FTAs and logistics reforms.

7. Support MSMEs to Scale Up

Encourage cluster development, common facility centres, and technological hubs.

Provide digital platforms for marketing and supply chain integration.

8. Implement Industrial Policies Effectively

Continue Make in India, PLI schemes for electronics, pharma, textiles, semiconductors, automobiles.

Stabilise policy environment to attract FDI and long-term investments.

Agricultural Marketing

1. Regulated Market Committees (APMC Acts)

States established regulated markets (mandis) to eliminate middlemen and ensure transparent auctioning.

Aim: Standardised weighing, fair trader practices, and reduced exploitation.

2. Establishment of the Food Corporation of India (FCI), 1965

Ensures procurement of food grains at Minimum Support Price (MSP).

Provides assured market to farmers and stabilises prices.

3. Minimum Support Price (MSP) System

Introduced in 1966–67 to guarantee remunerative prices.

Protects farmers from market fluctuations and distress sales.

4. Cooperative Marketing Societies

Formation of NCDC, NAFED, and State cooperatives to strengthen farmer bargaining power.

Helps in procurement, storage, and distribution.

5. Warehousing and Storage Reforms

Establishment of Central Warehousing Corporation (CWC) and State Warehousing Corporations.

Scientific storage reduces post-harvest losses.

6. Grading and Standardization

Introduction of AGMARK for quality certification of agricultural commodities.

Helps farmers obtain better prices in domestic and export markets.

7. Contract Farming Policies

Legal frameworks developed in several states to link farmers with agro-industries.

Provides assured markets, modern inputs, and technology.

8. National Agricultural Market (e-NAM), 2016

A pan-India electronic trading platform integrating APMC mandis.

Promotes transparent price discovery, reduces role of intermediaries, and enhances farmer reach.

9. Development of Rural Infrastructure

Projects like PMGSY (rural roads), RKVY, and RIDF improve connectivity and reduce transportation costs.

Cold chains, refrigerated vans, and pack houses support perishable commodities.

10. Marketing of Horticultural and Perishable Products

Setting up of NHB (National Horticulture Board) and cold storage facilities.

Establishment of modern terminal markets.

11. Strengthening Market Information Systems

- AGMARKNET and other digital platforms provide real-time price information to farmers.

12. Farmer Producer Organizations (FPOs)

Encouraged since 2011; offer collective marketing, input purchase, and processing.

Improves scale economies and bargaining power.

13. Amendments in APMC Acts

States encouraged to allow private markets, direct marketing, and contract farming.

Promotes competition and wider choice for farmers.

Farming System → doubling farmers’ income

Yes, I agree. The farming system is central to doubling farmers’ income because it determines how efficiently land, labour, water, and capital resources are used. Improving the farming system leads to higher productivity, lower costs, diversified output, and reduced risk — all of which directly contribute to higher farm income.

1. Enhancing Productivity

Modern farming systems include improved seeds, better irrigation, soil health management, and mechanization.

Higher yields increase the value of output per hectare, raising farm income.

2. Crop Diversification

Moving from traditional cereals to high-value crops such as fruits, vegetables, pulses, oilseeds, spices, and floriculture boosts returns.

Diversification also reduces price and climate risks.

3. Integrated Farming Systems (IFS)

Combining crops with dairy, poultry, fisheries, beekeeping, and agro-forestry increases total farm output.

IFS ensures year-round income instead of seasonal earnings.

4. Adoption of Technology

Precision farming, drip irrigation, ICT tools, and scientific practices reduce input costs and improve efficiency.

Technology widens access to markets and weather information, improving decision-making.

5. Improved Post-Harvest Management

Value addition, grading, processing, and storage prevent post-harvest losses.

Better supply chains guarantee farmers a higher share of the final price.

6. Market Reforms

Access to e-NAM, FPOs, contract farming, and direct marketing increases price realization.

Stronger market linkages help farmers shift from production-based approach to income-based approach.

Thus, transformation in the farming system is a critical driver for doubling farmers' income.

Role of Non-Farm Income in Doubling Farmers’ Income

Non-farm income — income from activities outside crop farming, such as livestock, rural industries, services, manufacturing, and wage labour — plays an increasingly important role in rural livelihoods.

1. Reduces Dependence on Agriculture Alone

Agriculture is seasonal and often vulnerable to weather, pests, and price fluctuations.

Non-farm income provides regular and stable earnings, lowering risk.

2. Livestock as a Major Contributor

Dairy, poultry, goat-rearing, and fisheries provide continuous cash flow.

In many states, livestock contributes 30–40% of farmers’ income.

Growth in animal husbandry is faster than crop agriculture.

3. Rural Non-Farm Enterprises (RNFE)

Activities like food processing, tailoring, carpentry, transport services, construction work, and handicrafts supplement farming income.

These activities help families move from subsistence to surplus.

4. Employment During Lean Agricultural Seasons

Non-farm work fills the income gap during non-sowing or non-harvest months.

It prevents seasonal unemployment and stabilizes consumption.

5. MGNREGA and Other Wage Employment Programs

MGNREGA provides guaranteed wage employment and supports rural household income.

This reduces the need for distress migration.

6. Skill Development and Rural Industrialization

Government schemes promoting skills, MSMEs, food parks, and rural clusters create opportunities outside farming.

This diversifies income sources and improves resilience.

7. Connection to Doubling Farmers’ Income Goal

Studies show that doubling farm income cannot be achieved from agriculture alone.

A significant share must come from:

livestock,

agro-processing,

rural services,

micro-enterprises,

wage employment.

Non-farm income thus becomes a critical pillar of income growth

Structural Changes in the Indian Economy (Last 40 yrs)

Over the past forty years, the Indian economy has transformed from a controlled, inward-looking economy to a market-driven, globally integrated system. These changes span production, trade, finance, employment, and governance.

1. Shift from Agriculture to Services

In 1980s, agriculture accounted for over 35% of GDP; today it is below 15%.

Services—IT, telecom, finance, healthcare—now contribute over 55% of GDP.

Structural transformation has moved labour and resources toward higher-value sectors.

2. Rise of the Private Sector

Reduction of licensing, deregulation, and economic liberalisation since 1991.

Private sector expanded in manufacturing, banking, telecom, aviation, retail, and infrastructure.

Public sector dominance declined.

3. Trade Liberalisation and Global Integration

Removal of import licensing, reduction of tariffs, and promotion of exports.

India became part of global value chains in IT, pharmaceuticals, auto components, textiles.

Foreign trade as a share of GDP rose significantly.

4. Growth of Foreign Investment

FDI permitted across multiple sectors after 1991 reforms.

Portfolio investments deepened India’s capital markets.

External sector became more resilient with higher forex reserves.

5. Financial Sector Reforms

Deregulation of interest rates, entry of private banks, strengthening of capital markets (SEBI).

Development of insurance, mutual funds, and corporate bond markets.

Introduction of IBC (2016) improved credit discipline.

6. Fiscal and Tax Reforms

Shift toward fiscal responsibility through FRBM Act (2003).

Introduction of GST (2017) unified the indirect tax system.

Reduction in corporate tax rates and rationalisation of subsidies.

7. Technological and Digital Transformation

Expansion of telecom and internet; emergence of digital economy.

Aadhaar, UPI, Jan Dhan, and DBT revolutionised financial inclusion and governance.

Start-up ecosystem and innovation accelerated.

8. Structural Changes in Manufacturing

Growth in automobiles, electronics, pharmaceuticals, engineering goods.

Yet manufacturing as a share of GDP remains around 15–17%, reflecting slow transformation.

Policies such as Make in India and PLI schemes aim to boost competitiveness.

9. Agricultural Transformation (Partial)

Declining share in GDP but rising productivity in some states.

Shift toward horticulture, dairy, poultry, fisheries.

Expansion of MSP, irrigation, micro-irrigation, and e-NAM.

10. Demographic and Labour Market Changes

Large youth population entering labour force.

Shift toward informal and services-based employment.

Growth of urbanisation and migration from rural to urban jobs.

11. Greater Focus on Social Sector Development

Expansion of education, health, nutrition, rural development schemes.

MNREGA improved rural employment security.

Growth of welfare programmes using digital delivery.

SHORT NOTES

(a) Fiscal Deficit

Fiscal deficit is the excess of the government’s total expenditure over its total revenue (excluding borrowings) in a given financial year.

It indicates how much the government needs to borrow to meet its expenditure.

Formula:

Fiscal Deficit = Total Expenditure – (Revenue Receipts + Non-Debt Capital Receipts)

A high fiscal deficit implies higher government borrowing, possible future inflation, and increased interest burden. A moderate deficit is often used to stimulate growth during recessions.

(b) Minimum Support Price (MSP)

MSP is the minimum guaranteed price announced by the Government of India for certain agricultural crops before the sowing season.

It ensures farmers a floor price so they are protected from sharp price falls in the market.

Key features:

Recommended by the CACP (Commission for Agricultural Costs and Prices).

Implemented mainly through public procurement agencies like FCI.

Encourages production of staples (wheat, rice) and ensures food security.

(c) Poverty Line

The poverty line is a threshold level of income or consumption needed to meet basic minimum needs such as food, clothing, shelter, education, and health.

Key points: